With VTS Data now officially live in London, VTS can take the industry's first-ever look at the performance of two global metros that are arguably the two most important bellwethers for global office demand and asset values.

How did these markets compare to one another?

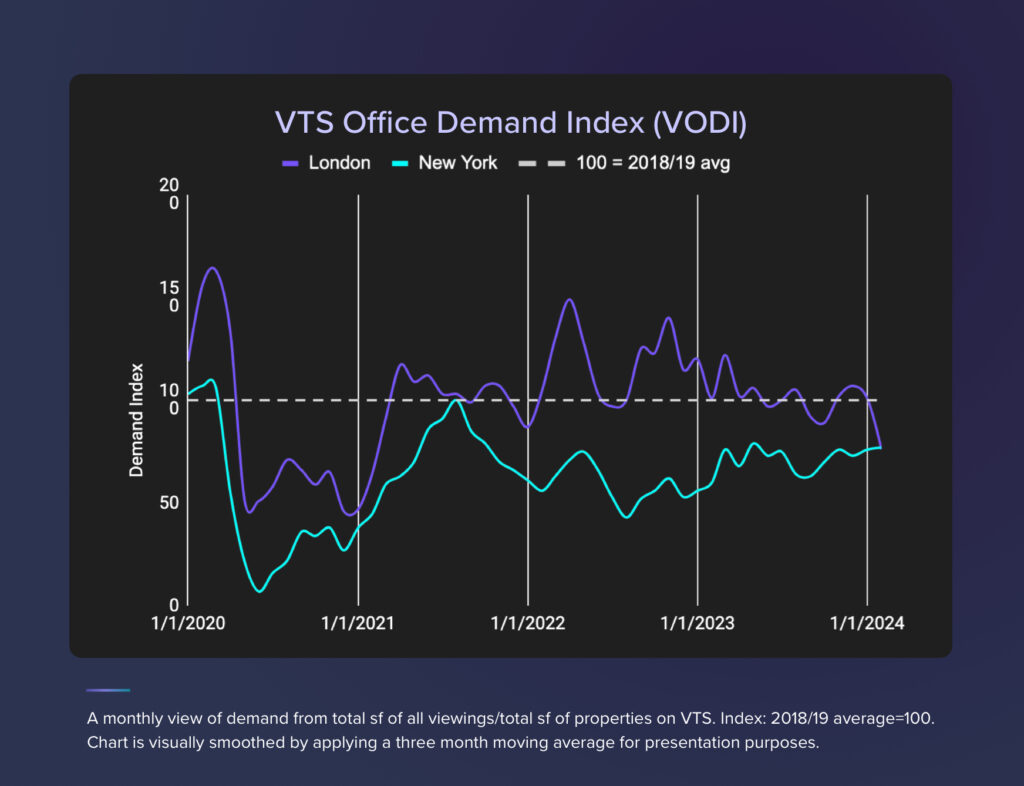

In February 2024, the VTS Office Demand Index (VODI) reported a score of 77 in NYC and 76 in London. YTD demand is only -5% and -6% in NYC and London, respectively, versus pre-pandemic levels (2018-2019).

This month, NYC had the best February VODI reading since the onset of the pandemic (77 in Feb. ‘24 vs. 60 in Feb. ‘23, & 56 in ‘Feb. 22). In London, demand levels returned to pre-pandemic levels in early 2021. However, February saw the largest monthly fall in the VODI since May 2020. This spells the first month London has fallen behind New York, the second best-performing gateway market in the U.S., just behind LA.

As of February '24, NYC had 30.6M sf of active tenants looking for office space, while London had 13.1M sf. NYC remained flat MoM and marks the 9th consecutive month of active demand at or above 30M sf, 11% higher than the monthly avg. in ‘21-’23 of 27M sf. London's active demand fell by 7% MoM, reflecting the first monthly fall in three months. Despite this, the number of requirements remains largely flat in 2024, indicating a fall in average requirement size.

London & NYC demand is driven by FIRE (Finance, Insurance & Real Estate) tenants, accounting for 37% of all active demand in London & 38% of all active demand in NYC. The “Other” sector (Public Sector, Healthcare, Customer Goods, Energy, and Charities) overtook TAMI (Technology, Advertising, Media & Internet) as the second largest sector share (32%) in NYC. In London, 'Other’ industries account for 20%, while the TAMI sector accounts for the second largest share of demand (23%). This is the sector's largest share since April ‘22.

Last year saw an increase in larger new monthly requirements. In London, the average size of 25K+ sf requirements increased by +32% sf YoY. 2024 data suggests a reversal of larger demand dominating with 25k+ sf requirements falling -35%. In NYC, the mega users in 2023 drove the average size of requirements 25k+ sf up 29% compared to 2022, but in February 2024, it dropped 38%.

Want more London Data? Take a look at the VTS Leasing Prediction Outlook for 2024, comparing our outlook for new demand entering the market in London, NYC, and San Francisco.